Khaberni - The board of directors of "Warner Bros. Discovery," an American company specializing in film and television production, announced today, Wednesday, it unanimously rejected the improved acquisition offer from "Paramount," confirming its preference for the competing offer from "Netflix."

"Paramount" did not increase the value of its offer - which remained at 108 billion dollars - but modified some of its terms, including adding a personal guarantee worth 40.4 billion dollars from American billionaire Larry Ellison, whose son David heads the company.

The Wall Street Journal reported on Wednesday that "Warner Bros. Discovery" advised shareholders to reject "Paramount"'s offer and confirmed that Netflix's offer was better.

"Warner Bros. Discovery" stated in its letter that "Paramount's offer is not superior, and cannot even be compared to the offer from Netflix valued at 72 billion dollars," for the acquisition of the film studios, television service, and streaming service "HBO Max" owned by the company.

Benefits of the Netflix Offer

Netflix offered to pay $27.75 per share for "Warner" studios and its streaming platform, following the company's split into two parts.

The Wall Street Journal explained that among the reasons that led "Warner" to prefer Netflix's offer is that its shareholders retain shares in the part of the company that Netflix will not acquire, which allows them to earn additional profits.

Warner mentioned in its letter to shareholders that it would lose billions of dollars if it abandoned the deal with Netflix, including a penalty of 2.8 billion dollars for terminating the agreement with them.

Netflix's offer is limited to acquiring "Warner Bros." studios and the entire "HBO" channel group (TV channels and the streaming platform "HBO Max") for 82.7 billion dollars including debts (72 billion dollars without debts).

On the other hand, "Paramount," in a hostile offer directed directly at shareholders, offered 30 dollars per share for the entire "Warner" company and all its services, including its satellite channels such as "CNN."

American billionaire Larry Ellison, founder of "Oracle" and father of Paramount CEO David Ellison, provided a personal guarantee to fund the stock purchase worth 40.4 billion dollars, in order to support the offer presented by "Paramount."

"Ellison Did Not Raise the Price"

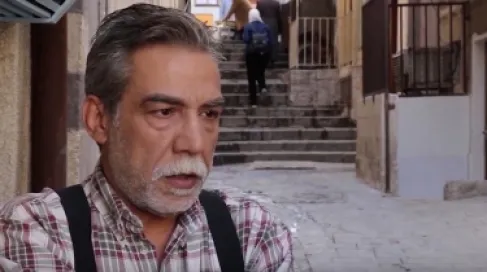

The Wall Street Journal quoted Samuel Di Biase Junior, chairman of "Warner," as saying today, Wednesday, in an interview with "CNBC" that Ellison provided a guarantee for Paramount's offer but "did not raise the price," adding that they need to offer "something better and convincing."

The Telegraph reported that the board of directors of "Warner Bros. Discovery" fears the large amount of debt involved in financing the acquisition by Paramount.

"Warner Bros." views the significant debt financing as increasing the "risks of the deal failing" compared to the "guarantee of merging with Netflix."

Di Biase confirmed that the offer from Netflix will ensure "better value with higher levels of certainty, without the large risks and costs imposed by Paramount's offer on our shareholders."

It is noteworthy that "Warner Bros. Discovery" is famed for a series of famous films including "Harry Potter" and "Batman," and is considered an icon of the American cinema industry.