Khaberni - The dollar bids farewell to the year 2025 under unprecedented pressure, as markets anticipate the outcome of the Federal Reserve chairmanship battle and the course of interest rates in America, according to a Bloomberg report.

According to Bloomberg data, the dollar is set to record its worst annual performance since 2017, as the Bloomberg Dollar Spot Index has fallen by about 8.1% since the beginning of the year, a direct reflection of shifts in U.S. policy and increasing investor bets on further monetary easing in the upcoming phase.

The Federal Reserve at the Center of the Scene

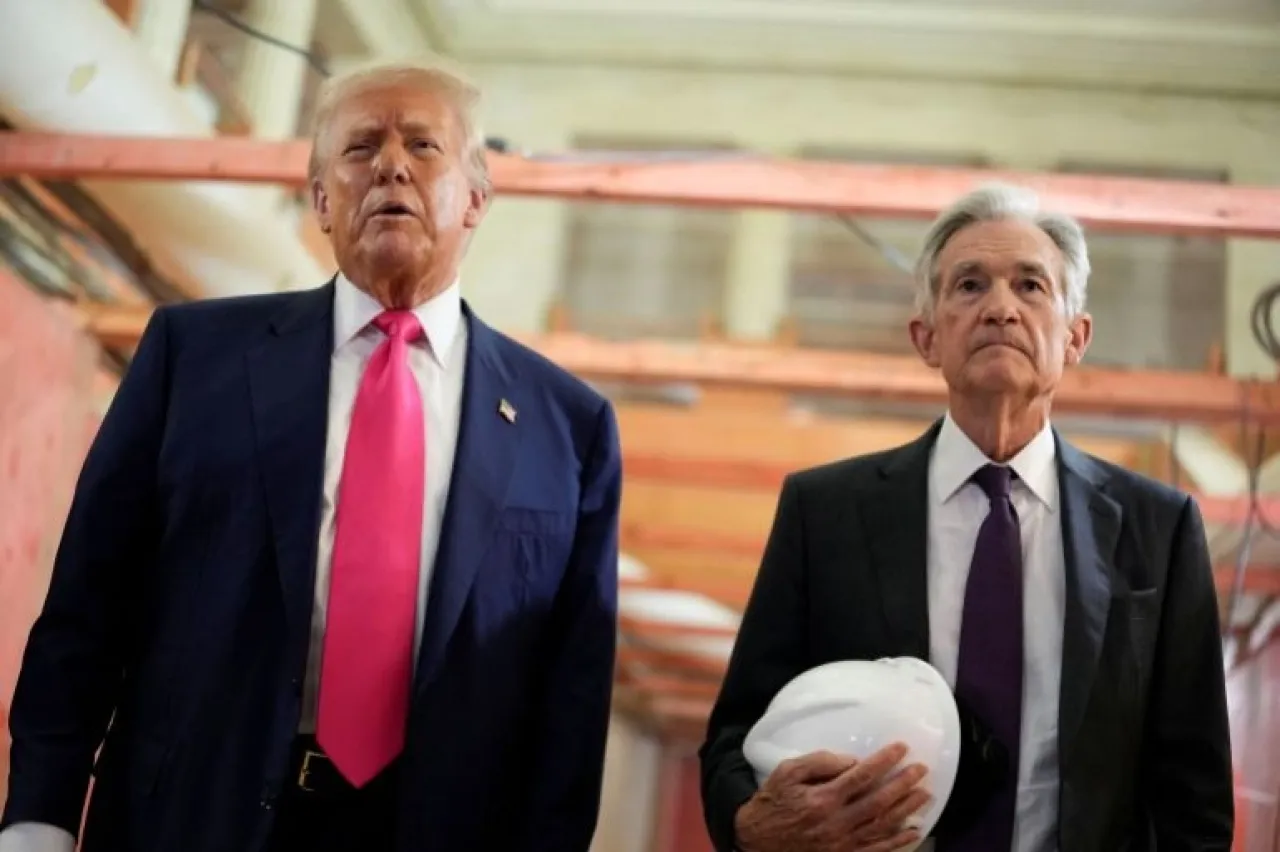

According to the report, markets agree that the decisive factor for the dollar's performance in the first quarter of 2026 will be the Federal Reserve, specifically who will be the next president of the central bank after Jerome Powell's term ends next May.

Yosuke Miyauchi, a currency analyst at Nomura, states that "the biggest influence on the dollar in the first quarter will be the Federal Reserve, not just the January and March meetings, but who will take over the presidency after Powell."

Bloomberg notes that the dollar has been under extended pressure since last April following the tariffs announced by U.S. President Donald Trump on what he called "Liberation Day," before the pressure intensified with his public campaign to push for the appointment of a figure more inclined to monetary easing at the head of the Federal Reserve.

Policy Divergence Weakens the Dollar's Appeal

As markets price in at least two interest rate cuts next year, the U.S. monetary path differs from several advanced economies, thus weakening the attractiveness of the American currency.

The euro has recorded strong gains against the dollar supported by the decline in inflationary pressures in Europe and expectations of a large defense spending wave, keeping the prospects for European interest rate cuts very limited.

In contrast, traders in Canada, Sweden, and Australia are betting on possible increases in interest rates, thereby widening the gap between the dollar and its main counterparts, according to Bloomberg.

The Return of Negative Bets

Data from the U.S. Commodity Futures Trading Commission - cited by Bloomberg - shows that speculators returned to adopting negative positions on the dollar in December after a brief period of optimism.

The value of net short positions on the dollar reached about $2.7 billion as of December 16, signaling renewed pessimism regarding the prospects of the American currency.

In a commentary analysis reported by Bloomberg, strategists warned against overbetting on a permanent weakness for the dollar, noting that historically high valuations are not a reliable indicator of price movements, and that consensus forecasts often come late compared to the actual market movement.

With the entry into the year 2026, the dollar seems stuck between policy pressures and interest rate fluctuations, waiting for a single decision that could redraw the map of global currency markets.