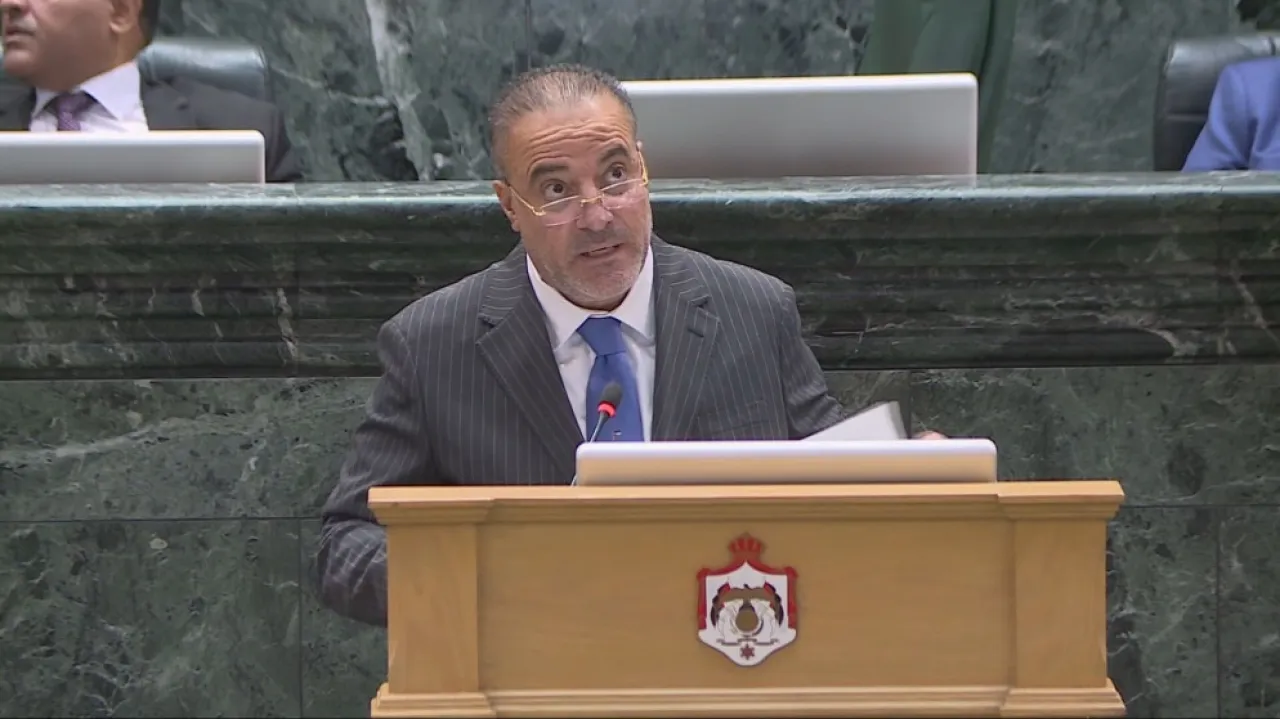

Khaberni - Finance Minister Abdulhakim Al-Shibli said that preparing the draft law of the general budget for 2026 was in the context of political and economic developments witnessed by the world, where the forefront of economic events included the tension in global trade relations and protective measures, and the continuing geopolitical tensions posed a strong threat to global economic prospects.

Al-Shibli added, during the Senate session held on Thursday to discuss the draft law of the general budget for 2026, that these developments had negative effects on the economic situations of the countries of the region and Jordan, and the government successfully managed to implement a package of economic decisions and effective measures to stimulate economic sectors and enhance financial stability. These decisions, strengthened by the factors of security and political stability enjoyed by Jordan, led to an improvement in the national economic indicators.

Al-Shibli pointed out that the real gross domestic product achieved growth of about 2.7% and 2.8% in the first and second quarters of 2025, respectively, the highest in two years. The balanced monetary policy succeeded in enhancing the stability of the dinar's exchange rate and creating a moderate price environment that prevented the decline in purchasing power while keeping the inflation rate at the lowest levels in the region. The central bank's foreign currency reserves also reached record levels, amounting to about $24.6 billion.

The text of the speech by the Minister of Finance before the Senators follows:

I am pleased at the beginning of this word to extend my thanks and appreciation to His Excellency the Chairman of the Financial and Economic Committee and to all the respected members of the committee for its report that includes a comprehensive and objective analysis of various sectors, and contains important recommendations in the areas that top our national interests.

I am also pleased on this occasion to extend my heartfelt thanks and appreciation to the honorable Lords the Senators for their contributions which included propositions and constructive ideas derived from deep experiences about the draft law of the general budget for 2026, which will contribute to enhancing the progress and prosperity of our beloved homeland under the leadership of His Majesty King Abdullah II ibn Al-Hussein, may God preserve and protect him.

The preparation of the draft law of the general budget for 2026 came in the context of the political and economic developments that the world witnessed, where the forefront of economic events included the tension in global trade relations and protective measures, and the continuation of geopolitical tensions posed a strong threat to global economic prospects.

These developments had negative effects on the economic situations of the countries of the region and Jordan. The government successfully managed to implement a pack of economic decisions and effective measures to stimulate economic sectors and enhance financial stability. These decisions, strengthened by the factors of security and political stability enjoyed by Jordan, led to an improvement in the national economic indicators. The real gross domestic product thus achieved growth of about 2.7% and 2.8% in the first and second quarters of 2025, respectively, the highest in two years. The balanced monetary policy succeeded in enhancing the stability of the dinar's exchange rate and creating a moderate price environment that prevented the decline in purchasing power while keeping the inflation rate at the lowest levels in the region. The central bank's foreign currency reserves reached record levels, about $24.6 billion.

Regarding the public finances, the government managed to contain the general budget deficit despite the significant regional challenges at the same level estimated for 2025, about 5.2% of the gross domestic product, and to maintain the primary deficit at the level estimated for 2025, about 1.9% of the output. Additionally, consecutive increases in debt service were controlled in light of the government's actions to replace costly borrowing with concessional borrowing at reduced interest rates.

Accordingly, the total public debt is expected to gradually decline, supposed to reach about 83.4% of the output in 2025, excluding what the Social Security Investment Fund holds, or about 108.3% of the output including what the Fund holds.

The investment environment was also successfully enhanced, resulting in an increase in foreign direct investment during the first half of this year to approximately one billion dollars. The tourism income exceeded $7 billion by the end of November. The national exports increased by about 9.1% during the first nine months of this year, and remittances from Jordanian workers abroad rose to about $3.7 billion by the end of October.

These positive developments in the macroeconomic field have enhanced the confidence of international institutions and their appreciation for the structural reforms carried out by Jordan to support growth. The latest being the completion of the fourth review within the national program for financial and economic reform and the first review for the program to facilitate sustainable resilience, a new international confidence certificate regarding the solidity of the national economy and the government's economic and financial policy. Credit rating agencies have also unanimously agreed to affirm their credit rating for Jordan.

This government, since its appointment by His Majesty the King, may God preserve and protect him, has been proceeding with firm steps to achieve the aspirations of the economic modernization vision and continue achieving growth and raising living standards.

The budget for 2026 was built on key pillars, including accelerating the pace of implementing the economic modernization vision projects, directing spending to support the growth engines identified by the vision, consolidating the fiscal policy orientations to maintain financial stability and not burdening future generations with any unwieldy decisions, enhancing the developmental character of the general budget, and enhancing the social protection requirements for citizens, improving the health sector to enhance the quality of life and enabling the citizen to actively contribute to bu...