Khaberni - The influence of the Olayan family has emerged on the global stage as one of the strongest Saudi investment empires, led by the sisters Lubna and Hudam Al-Olayan. With massive investments in the American financial markets "Wall Street", and a pivotal role in the Saudi economy, the investment group has transformed into a financial player operating on a scale comparable to sovereign wealth funds, with a quiet presence and a broad impact that exceeds the announced figures.

Escalating influence and a conglomerate the size of a sovereign fund

The sisters grew up during a time when women in Saudi Arabia were not allowed to drive, and they were required to obtain a guardian's permission even to apply for a passport. Nonetheless, they managed to transform the family conglomerate into a giant entity operating on the scale of a sovereign fund. The group controls a portfolio of stocks in the United States valued at approximately $13 billion, including stakes close to $1 billion in BlackRock, and $1.5 billion in the investment bank J.P. Morgan Chase, according to official disclosures.

While the Saudi group was a major investor in the Swiss bank Credit Suisse before its collapse, it also owns a distinguished real estate portfolio extending from Madison Avenue in New York to central London. It concluded a significant real estate deal in Dubai with Brookfield, alongside extensive investments in private equity and fixed income.

Within Saudi Arabia, the group manages Coca-Cola bottling, operates Burger King restaurants, and provides services to oil fields. These investments have turned the Al-Olayan family into one of the richest families in the world, with a fortune valued at more than $50 billion according to the Bloomberg Billionaires Index, which listed them for the first time in its annual ranking. However, this figure does not reflect the true size of the family's fortune, according to knowledgeable sources, due to the limited financial disclosure of the group.

Many have estimated the Olayan's wealth at more than $100 billion, placing them in the league of Bill Gates, Carlos Slim, and Mukesh Ambani. It makes the Olayan family richer than Prince Alwaleed bin Talal, known as the Warren Buffet of Saudi Arabia. The family's influence is not limited to its financial power but also extends to its national role, as its loyalty to the Kingdom during challenging times has made it an indispensable pillar, according to informed sources.

Wall Street seeks advice

Senior officials in Wall Street often turn to the family for advice, amid their efforts to expand into the economy of Crown Prince Mohammed bin Salman, which is valued at around $1.3 trillion. Steven Hertog, a professor at the London School of Economics and Political Science, said: "Mohammed bin Salman continues to be drawn to the United States as his preferred partner in the fields of security and economic development. The presence of private sector brokers with strong ties to American finance is beneficial."

The representative of the Olayan Group in the United States did not comment, directing all inquiries to a spokesperson in Saudi Arabia, who did not respond to a detailed list of questions. Most global executives avoid speaking about the family to avoid causing their displeasure, as the sisters are known for their strong privacy concerns. This report is based on an analysis of the family's investments and operational companies and legal disclosures of the entities it owns, along with interviews with more than six knowledgeable individuals who requested anonymity.

Wall Street leaders: Roots of influence

Born in Saudi Arabia to their father, Sulaiman Al-Olayan, Lubna and Hudam Al-Olayan are both in their early seventies. Their father’s father had died at a young age, and he began his career as a guidance officer at a company that preceded Saudi Aramco, benefiting from his proficiency in English. He mortgaged his house for $8,000 to secure a pipeline contract, according to a report published by Time magazine, before founding the Olayan Group in 1947.

Since then, the group's activities have diversified widely, including marketing partnerships for Colgate toothpaste, Oreo biscuits, and Coca-Cola in the Kingdom. Sulaiman Al-Olayan also invested in American stocks to use them as credit guarantees at American banks. By 1980, the group’s annual revenues exceeded $300 million, according to the same report.

The global orientation of the father has built a dual-identity empire, deeply ingrained in his daughters from an early age. The sisters studied in the United States, and on returning, they immediately took up senior positions in the family business. After the death of Sulaiman Al-Olayan in 2002, his son Khaled was appointed head of the Olayan Group, but Lubna and Hudam took on significant management roles.

Lubna managed the activities in the Middle East, while Hudam managed the Olayan America. Both sisters married foreigners and held prominent roles; Lubna became the first woman to be elected to the board of a listed company in Saudi Arabia in 2004. At that time, women’s rights in the Kingdom were still severely limited, and they were not allowed to drive until 2018.

Low presence... Wide impact

In an interview with the National Public Radio (NPR) in 2018, Lubna recalled the difficulties she faced in finding women's bathrooms inside factories and meeting rooms, given the rarity of women's presence. She began reaching out to government officials and executive directors to advocate for increased women's participation in the workforce, taking care to avoid direct confrontation. She said in the interview: "You negotiate, you deal, you give and take." Over the years, the sisters gained a reputation as stern negotiators, aided by maintaining an image supportive of government goals.

The official headquarters of the group today is in Liechtenstein, and it has offices around the world, including in Athens, where Lubna's husband, a lawyer, has broad connections. The family has gained a reputation for managing a highly professional and disciplined organization, a rare level among family businesses. Josiane Fahed-Sreih, director of the Institute of Family Business and Entrepreneurship at the Lebanese American University, said: "The family was very aware of the importance of integrating institutional governance frameworks and implemented it with a high level of professionalism." In a sign of its influence, the Olayan family was not affected by the arrests campaign witnessed in Saudi Arabia in 2017, which targeted dozens of princes, officials, and businessmen, including Prince Alwaleed bin Talal.

Investment stumble... Without shaking the image

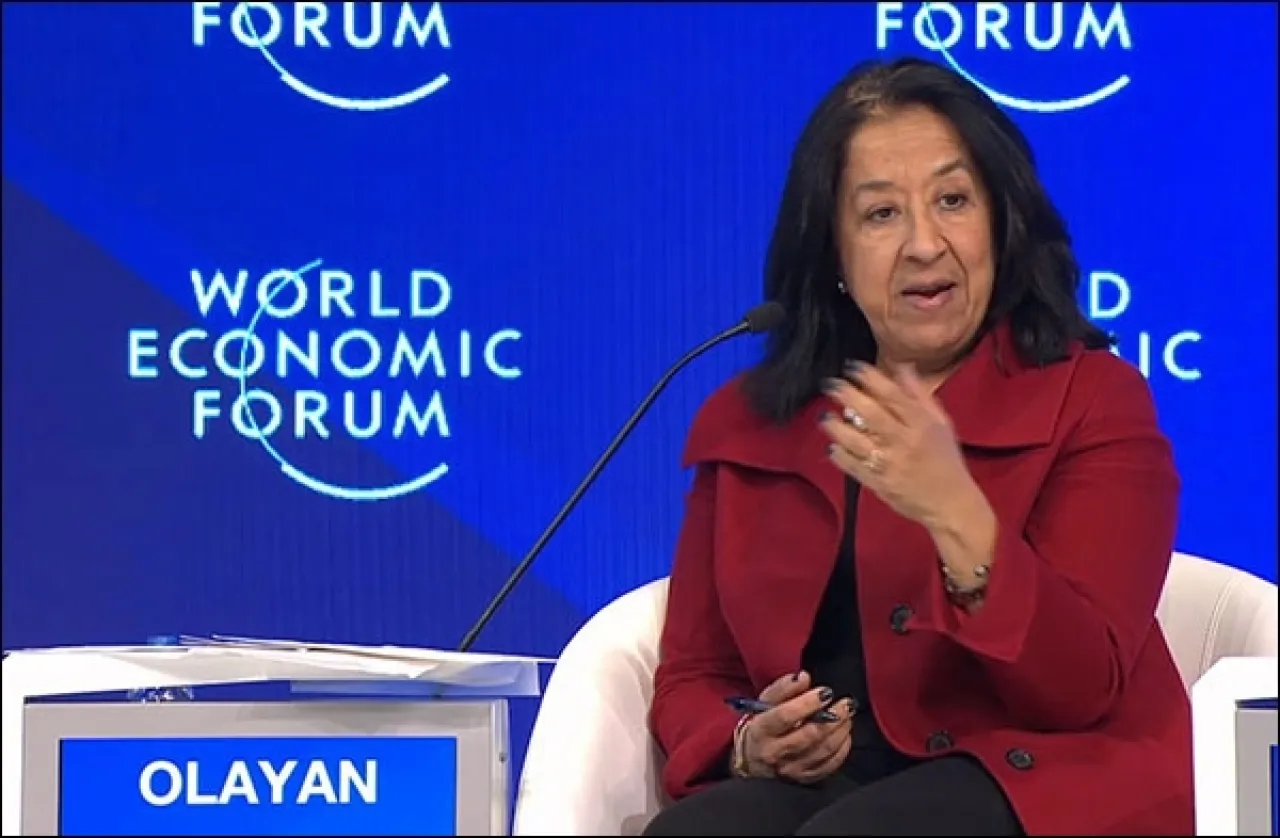

The wealth of Prince Alwaleed bin Talal currently stands at about $17 billion, having made a partial comeback in recent years, benefiting from a construction boom in the Kingdom. In the nineties, he was known for a flamboyant lifestyle, often appearing aboard a private yacht he bought from Donald Trump. The Olayans, however, have a different approach. Hudam Al-Olayan said in a speech in 2013 before the Arab Bankers Association of North America: "We generally do not seek the spotlight.. and we avoid ostentatious displays, leaning towards austerity."

Yet, the journey has not been without investment errors. The group was among the major investors in Credit Suisse, holding onto the bank despite its decline, resulting in significant losses after UBS took it over. Despite the magnitude of the losses, the group dealt with them as relatively normal, according to one international executive, and financial operations continued without disruption. While the chairman of the board of the Saudi National Bank, the largest shareholder in Credit Suisse, resigned after the crisis, the Olayan Group continued to bolster its presence.

Network of relationships and investments across continents

The influence of the group is linked to its close relationships in Wall Street and within the Kingdom, especially with the rising pressure on foreign companies to invest locally and contribute to diversifying the economy. Lubna has close relationships with Black Rock's founder Larry Fink, and she was recently appointed co-chair of the American-Saudi Business Council alongside Jane Fraser. Hudam holds a seat on the board of Brookfield, one of the largest private equity investors in the Middle East.

At this year’s Future Investment Initiative conference, known as "Davos of the Desert," Lubna hosted a party in Riyadh attended by top financial executives and officials, according to one attendee. The family's investments are not limited to the financial sector, with their U.S. equity investments valued at $12.7 billion, including stakes in Microsoft, Alphabet, and Amazon.

In comparison, the investments of the Saudi sovereign wealth fund in U.S. stocks do not exceed $19 billion. The group's private equity portfolio is valued at tens of billions of dollars, while its real estate investments span over 40 million square feet, including about 40,000 managed apartments. Domestically, the family supported major national projects, including the initial public offering of Aramco in 2019 when it faced difficulties attracting foreign investors.

Balance in public positions

At the same time, Lubna has maintained a delicate balance in her public stances. In 2018, after the killing of journalist Jamal Khashoggi, she opened one of the sessions at the Future Investment Initiative conference by offering condolences, considering the crime to be contrary to Saudi values. She stated then: "We are grateful that the horrifying actions reported in recent weeks are foreign to our culture and identity." Lubna currently holds the position of founding chair of the board of the group, while Hudam presides over the shareholders' council. The daily operations are managed by the executive management, while the sisters continue to lead the overall strategic direction.