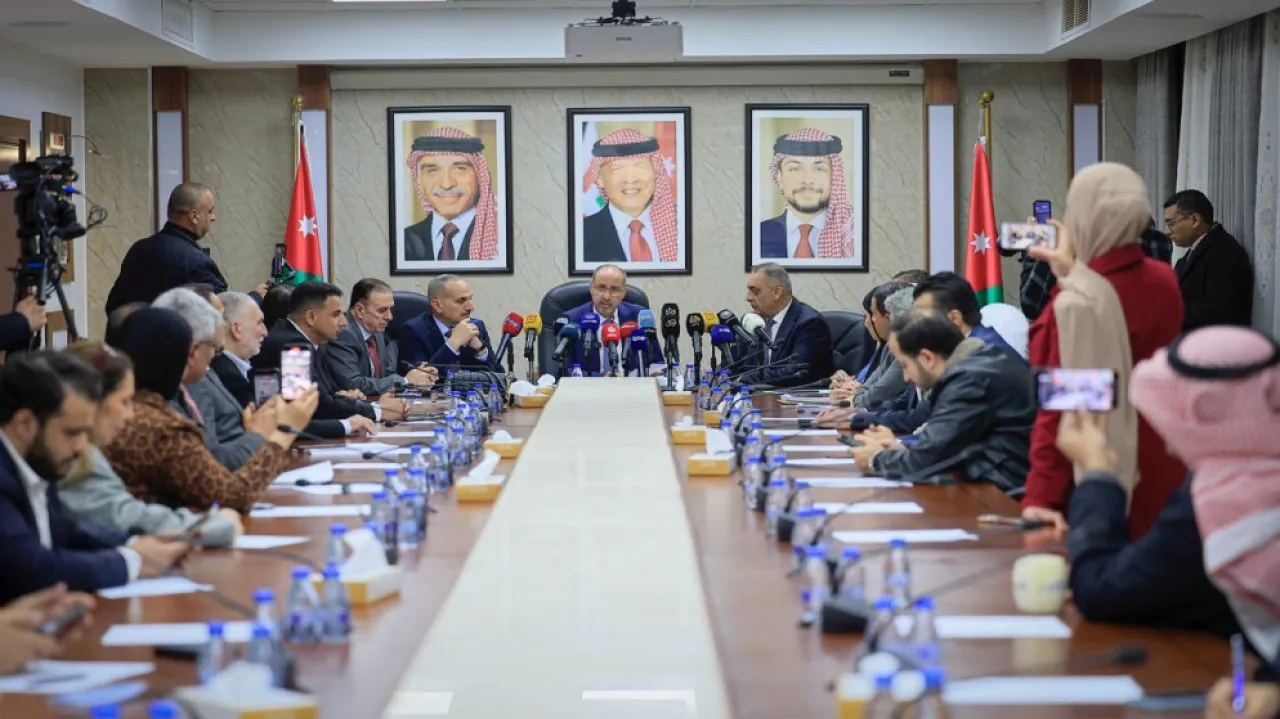

Khaberni - The Financial Committee of the Representatives, chaired by Nimr Al-Sleihat, on Sunday approved the public budget bill for the fiscal year 2026, after concluding its discussions which lasted over 104 meetings from November 25 to December 7, and included all ministries, departments, and government units listed in the budget.

Al-Sleihat stated that the committee conducted an in-depth technical study that covered the analysis of budget items, assessment of the impact of public expenditures, evaluation of economic indicators, in addition to reviewing the impact of 230 government decisions on economic and social conditions, and discussing allocations for social safety networks.

The committee expressed its thanks to the Speaker of the House of Representatives, Mazen Al-Qadi, for his support, and to all the representatives and journalists who followed its proceedings.

Al-Sleihat, during a press conference, clarified the main recommendations of the committee as follows:

First: Fiscal and Monetary Policy

Increase the salaries of employees in the military, civil sectors, and retirees equivalent to cumulative inflation.

Reevaluate the sales tax taking into account its impact on citizens' incomes.

Reduce the costs of servicing public debt, and benefit from low-interest external financing, with an expectation of a half percentage point interest rate decrease in 2025.

Refrain from imposing new taxes or shifting goods to a higher tax bracket.

Restrict allocation of emergency funds amounting to 60 million dinars to necessities only.

Link the growth of current expenses in government companies to no more than 25% of the actual revenue growth.

Create an investment fund for retirees and employees to finance major projects, including the "Umrah" project.

Allocate sufficient funds for the tax refund file.

Extend the decision to stimulate real estate trading and exempt apartments of 150 m² and below by 100%, and 50% for larger areas.

Obligate banks to reflect the interest rate reduction decision on loans with the same speed as they reflect increases.

Continue the Central Bank's low-interest financial programs.

State Audit Bureau

Conduct a comprehensive assessment of the impact of stopping prior control.

Adopt clear standards for classifying entities subject to prior control before withdrawing from pre-audit.

Study the efficiency of internal control units in government institutions.

Tourism Sector

Diversify tourism programs in less popular areas and link them to overnight stays and low-cost flights.

Expand cultural tourism programs aimed at Arab visitors.

Prepare a gradual development plan for tourist sites and launch partnership projects with the private sector.

Connect craft associations with the most frequent visitor demographics.

Water and Agriculture

Continue reducing water loss and preventing encroachments on networks.

Support cooperative associations and agricultural manufacturing to revitalize local communities.

Conduct annual surveys of sheep to ensure that support reaches the deserving.

Support alternative agriculture suitable for regional characteristics.

Monitor production and compensate for any shortfalls via an early-warning system to stabilize prices.

Education and Higher Education

Train and qualify teachers in BTec programs and expand their implementation.

Direct universities to adopt technical and future-oriented specializations.

Continue supporting the Poor Student Fund.

Ministry of Labor

Expand vocational and technical training according to international standards, especially for the German labor market.

Regulate the labor market and regularize the status of violators.

Support entrepreneurship and innovation, especially in the technology and artificial intelligence sector.

Ministry of Digital Economy and Entrepreneurship

Complete the digital transformation plan and provide all government services electronically.

Develop infrastructure for artificial intelligence.

Enhance training programs for IT students that conclude with employment.

Industry and Trade

Unify support programs for small and medium enterprises and launch new programs after studying their challenges.

Support rural production projects within a unified program.

Create a unit to protect investors, especially for goods traded via social media platforms.

Investment Field

Follow up on the results of His Majesty the King's visits to maximize investment opportunities.

Prepare feedback for the Investment Environment Law with the aim of developing it.

Reduce bureaucracy by reengineering procedures.

Amend the investment environment system to align with the vision for economic modernization.

Provide additional incentives for investors in the provinces.

Additional Recommendations

Equalize the perks of the Mufti of the Religious Affairs Directorate with those of Sharia judges.

Extend the exemption of building fees by 75%.

Increase the allocations for the armed forces and security agencies to enhance readiness.

The committee affirmed that the approval of the budget bill is based on a comprehensive technical evaluation, aiming to enhance the efficiency of public spending, improve service levels, and support economic growth, reflecting positively on citizens and the national economy.