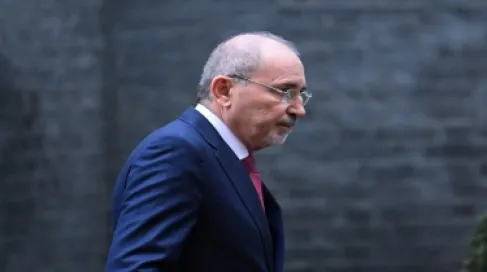

Khaberni - Omar Malhas, the chairman of the Social Security Investment Fund board, said on Tuesday that the fund recently purchased lands including those situated within the Umrah area, obtained at an exclusive rate 30% below the administrative price.

Malhas valued the government's cooperation and the opportunity it provided the fund to participate in these strategic projects, expressing his gratitude for the cooperation that contributed to obtaining this discounted rate and for the direct support it represents to enable the fund to enter projects that enhance its returns in the long term.

He explained that the fund has a clear plan to engage in real estate development projects, noting that the fund continuously follows investment opportunities available in major national projects, including the national water carrier project, the Risha gas pipeline, and strategic energy and infrastructure projects, affirming that any national project yielding a return over 10% would be within the fund's interest scope, aligning with its long-term investment policy.

Malhas clarified that investing in land and real estate forms a fundamental part of the fund's investment system, as these are considered safe and stable investments that yield good returns in the long term, especially since the average age of social security members ranges between 30–35 years, making long-term investment a logical and fruitful option.

He added that the fund's participation in major national infrastructure projects comes as part of an orientation towards improving returns within the same risk levels, pointing out that strategic projects like the national carrier, the gas transport pipeline, and the Risha gas line offer promising opportunities for the fund and represent a quality addition to its investment portfolio.

He indicated that the requirements for developing new areas necessitate a comprehensive infrastructure, transport systems, and railways, which also represent significant investment opportunities that the fund can enter through various options, including real estate leasing under the BOT system, where the project returns to the fund after the operation period ends.

Malhas revealed that the current investment value of the fund in real estate and lands is about 5% of its assets, while the investment policy allows expansion up to 10%, affirming that the expansion will be directed towards projects that achieve the highest possible return over a time frame exceeding 10 years.

Regarding treasury bonds, Malhas explained that the fund owns about 10 billion Jordanian dinar in government bonds, which are among the safest investments, as the government has never defaulted on its obligations in the local currency, and pays due amounts on time without any delay.

He confirmed that the fund has invested in ownership and financing instruments in a number of major national companies, including the Jordan Phosphate Mines Company in which the fund owns 16%, and these investments have contributed to enhancing the overall returns of the fund.

Malhas emphasized that the investment decision in the Social Security Investment Fund is institutional and independent, taken based on in-depth studies, and does not subject to discretion, indicating that the Social Security law and the investment fund system clearly define the mechanisms for entering into investment projects.