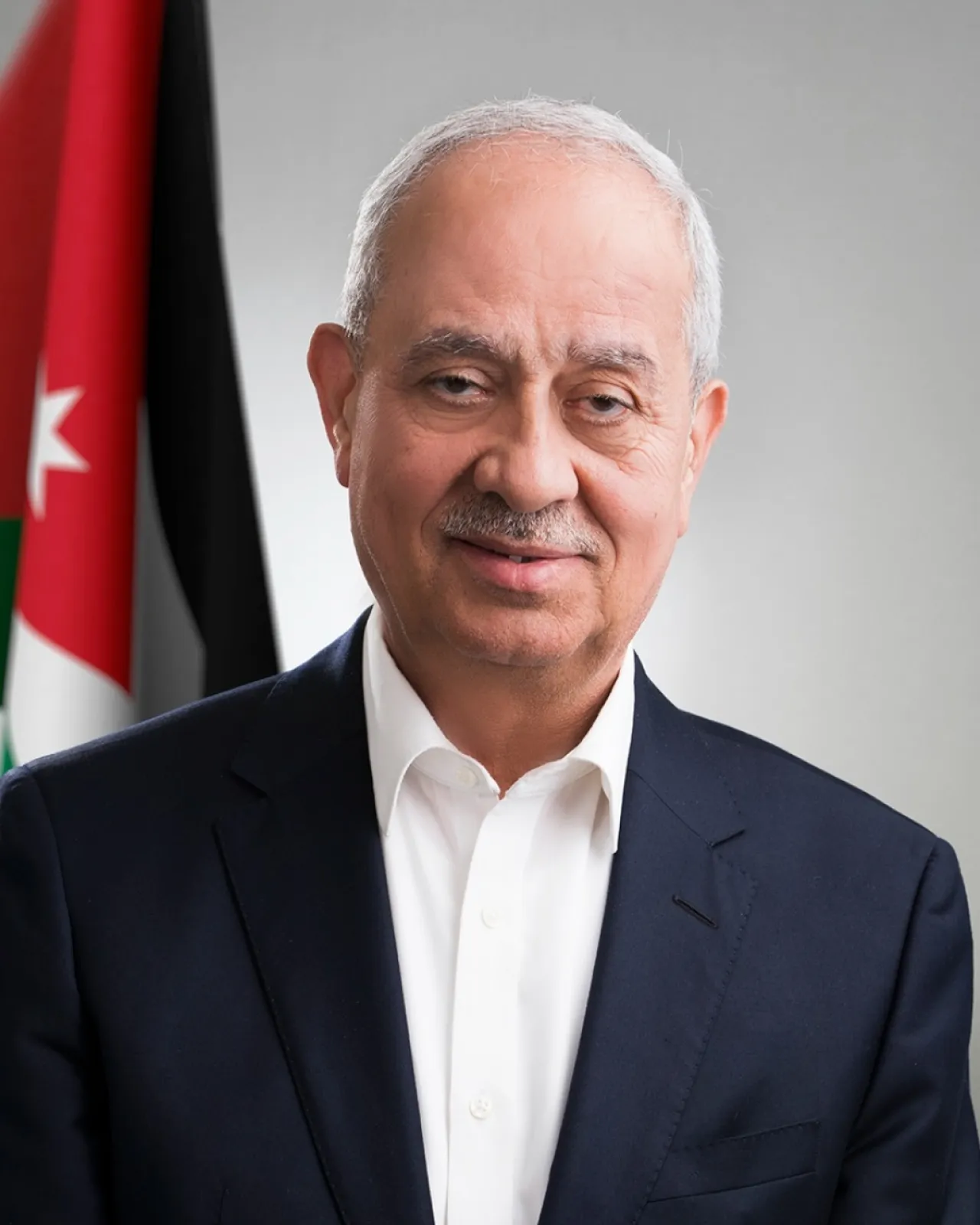

Khaberni - The head of the Amman and Jordan Chambers of Industry, Engineer Fathi Al-Jaghbeer, praised the Cabinet's decision to amend the customs tariff schedules following a study of the decision's economic impact over the past period.

Al-Jaghbeer explained that this decision translates the government's policy in supporting the national industry and complements its recent decisions aimed at enhancing the competitiveness of the Jordanian industry in the local market and export markets, adding that all countries protect their industries, especially if they enjoy high quality and prices suitable for citizens, noting that more than 90% of imports to the kingdom enter duty-free.

Al-Jaghbeer affirmed that balancing industry support with citizen interest is a national necessity, indicating that the government handled the customs tariff issue with professionalism and responsibility, noting that the latest decision followed its freeze at the beginning of 2025 on the tariff modifications approved in 2022, with the purpose of re-evaluating their impact on the local market and the industrial sector, aiming for a more balanced and equitable formula for the national economy.

He clarified that the amendment was limited to goods that have a local substitute, with an exemption for food items that have no substitute, and a complete exemption for clothing and children's supplies, along with the continued exemption of industrial production inputs from duties, clearly reflecting the government's commitment not to affect the daily needs of citizens, while simultaneously supporting Jordanian factories and providing fair competition with imports.

Al-Jaghbeer added that in 2024, the percentage of imports subject to customs duties according to the tariff schedules was 10.7% of the total imports, while the percentage of imports exempt under the tariff schedules was 45.7%, the percentage exempt under free trade agreements was 28.2%, and the percentage exempt under Cabinet decisions or special laws was 15.4%, thus the decision's impact would not result in any effect on local prices for the citizen, especially since the average customs duty in Jordan will increase from 3.8% to only 4.5%, meaning the increase will not exceed 0.7 percentage points, and after the new amendment, it will remain lower than the tariff rate in most neighboring countries.

He pointed out that according to the import structure during the first nine months of 2025, about 72% of the total imports subject to customs duties and not exempted by free trade agreements have a local substitute, while about 60.5% of the import structure consists of raw materials, capital goods, and intermediate goods not directly consumable, thus the impact of customs duties does not exceed 2.9% of the overall tax burden in Jordan, and low-income groups, which constitute about 52% of households in Jordan, will not be affected by the decision since most of their consumption of essential goods is either not subject to customs duties or is locally made.

Al-Jaghbeer affirmed that the local industry is capable of covering the local demand with high-quality and efficient products, as proven by the local industry during the Corona pandemic and recently through campaigns to support the national product as part of the new strategy to enhance local demand for national products within the scope of supporting priority sectors included in the Economic Modernization Vision, in addition to the prestigious position of national products in various global markets where our products today reach more than 155 markets around the world, and that supporting the local industry will actively contribute to creating more industrial investments locally and will effectively enhance local production which necessarily means creating more job opportunities for Jordanian youth since the industrial sector is the largest creator of jobs at the national level.

Al-Jaghbeer emphasized that raising customs duties will not have a noticeable impact on prices in the local market, while the rise in prices of imported products globally has a larger impact on local inflation rates, as we have seen in the past few years despite reducing tariff rates, local prices have risen according to the Consumer Price Index (CPI). Supporting the local industry and purchasing the national product will benefit various economic sectors since the industrial sector has many direct and indirect linkages with various sectors, as every dinar spent on national products returns to the national economy more than 2.17 dinars.